Beauty in Bloom: Navigating Vietnam’s Cosmetics Market and 2024 Trends

Overview of Vietnam’s Cosmetics Market

Vietnam’s cosmetics market ranks among the most dynamic in Southeast Asia. From 2018 to 2022, the female user base of beauty products rose from 76% to 86%, with an expected annual growth rate of 15–20%.

However, significant growth comes with notable challenges. Market pressure requires continuous improvements in product quality and innovations to maintain competitive advantage.

I. Product Trends & Market Structure

1. Dominance of Imports

-

Imported products account for 93% of cosmetics sold in Vietnam, with import value reaching approximately USD 950 million in 2019, according to the U.S. Department of Commerce.

-

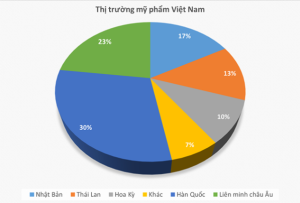

South Korea leads with 30% market share, followed by the EU, Japan, Thailand, the U.S., China, and Singapore.

-

K-beauty brands leverage celebrity endorsement—from BTS and SNSD—and multi-channel campaigns to drive popularity.

2. Rise of Domestic Brands

-

Local brands such as Thorakao, Saigon Cosmetic, Sao Thai Duong, and Cocoon are gaining traction by offering culturally relevant, reasonably priced, and increasingly stylish products.

II. Demand by Customer Segments

1. By Age

-

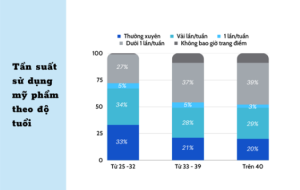

Consumers aged 25–32 spend an average of VND 700,000/month, compared to VND 610,000 for those 33–39 and VND 590,000 for those above 40—making 25–32 the primary target audience.

2. By Income

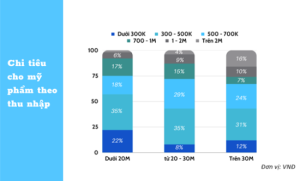

Higher income correlates with increased beauty expenditure, indicating positive momentum in premium segments.

3. By Distribution Channel

-

(a) Traditional retail: supermarkets, drugstores, specialty outlets.

-

(b) E‑commerce (Shopee, Tiki, Lazada, Amazon, TikTok): 44% of consumers aged 25–32 prefer online shopping.

-

(c) Direct-to-consumer: via brand websites or flagship stores.

-

(d) TV shopping: complements other channels despite limited reach.

III. Opportunities & Risks

1. Opportunities

-

High demand for imported segments: facial cleansers, moisturizers, lip products, eye make-up, hair care, and men’s grooming—eye makeup alone valued at over USD 140 million in 2019.

-

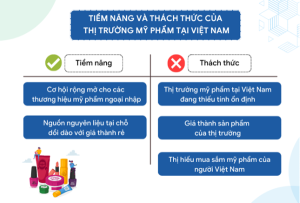

Local ingredients: materials like coconut, turmeric, green tea, aloe are readily available, supporting natural and organic brand strategies, with cost advantages and favorable tax and logistics conditions.

-

Leading global players: Unilever (~12% market share), Beiersdorf (Nivea), LG (Ohui, The Face Shop), AmorePacific (Laneige, Innisfree), and L’Oréal are heavily invested in Vietnam.

2. Challenges

-

Market volatility influenced by Hallyu trends and social media can rapidly alter consumer preferences, posing a challenge for brands and distributors.

-

Price sensitivity demands effective cost–quality balance and local production strategies.

-

Regional preference bias: many Vietnamese consumers favor East Asian brands, requiring Western brands to emphasize proven efficacy and reliability.

IV. Key Trends in 2024

-

Sustainability: lifecycle eco-responsibility, recyclable packaging, reduced carbon footprint are becoming prerequisites.

-

Spending control: with over 80% reporting price increases, NIQ (2022) shows 24% reduced spending, 47% maintained, and 29% planned to spend more. Brands must align with evolving consumer budgets.

-

Innovation wave: after a lull in 2022, 2023–24 offer prime conditions for launching new product lines focusing on personalization, clean ingredients, inclusivity, and digital integration (AI, AR/VR).

-

Brand influence: premium brands grew revenue by over 30% in 2022, though consumers are becoming more discerning.

-

Price–trust dynamics: Association between price and value is increasingly important; brands must deeply understand customer motivations and concerns.

V. Summary

-

2023: marked by explosive growth, diversification, health-focused, natural product adoption, and digital transformation.

-

Forecast for 2024: continued robust expansion with emphasis on sustainable and tech-enabled cosmetics.

-

Strategic imperatives for businesses: quality excellence, continuous innovation, omnichannel distribution, and adaptive agility to thrive in Vietnam’s fast-evolving market.

Follow https://gmp.com.vn/tong-quan-thi-truong-my-pham-tai-viet-nam-%E2%80%93-xu-huong-thi-truong-my-pham-2024-n.html